The Best Guide To Small Business Accountant Vancouver

Wiki Article

The Best Guide To Vancouver Tax Accounting Company

Table of ContentsWhat Does Small Business Accounting Service In Vancouver Do?The Only Guide for Small Business Accounting Service In VancouverThe Basic Principles Of Vancouver Accounting Firm Rumored Buzz on Cfo Company Vancouver

That happens for every single purchase you make throughout a given bookkeeping duration. Working with an accountant can aid you hash out those information to make the audit process work for you.

What do you make with those numbers? You make changes to the journal access to make certain all the numbers accumulate. That may consist of making corrections to numbers or handling built up things, which are expenses or income that you sustain yet don't yet spend for. That gets you to the readjusted trial balance where all the numbers build up.

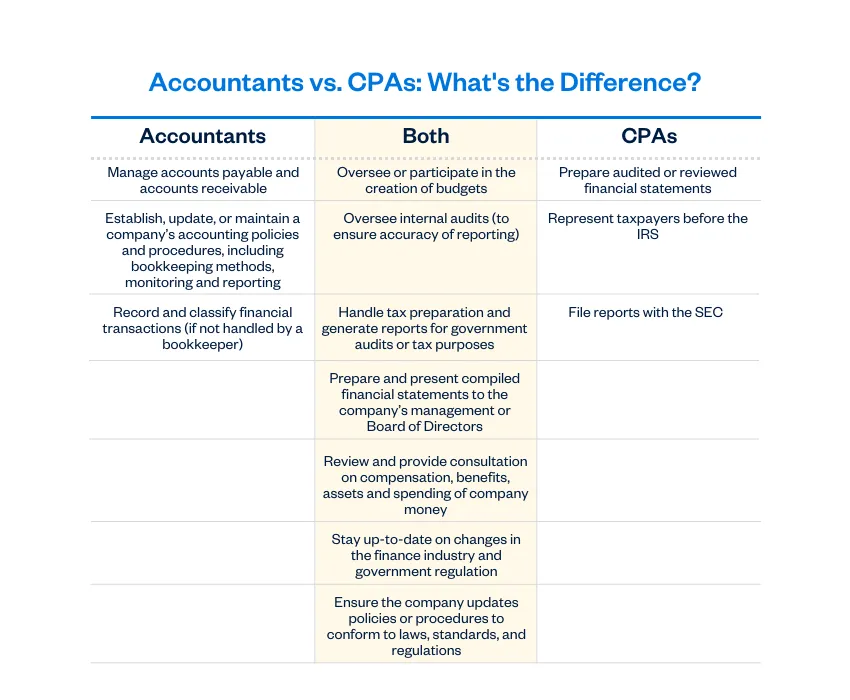

For aiming financing specialists, the inquiry of accountant vs. accounting professional prevails. Bookkeepers and also accountants take the exact same foundational accounting training courses. Nonetheless, accounting professionals go on for further training as well as education and learning, which causes distinctions in their duties, incomes assumptions and also profession development. This overview will provide a detailed break down of what separates accountants from accountants, so you can recognize which accounting role is the most effective suitable for your job ambitions currently and in the future.

How Tax Consultant Vancouver can Save You Time, Stress, and Money.

An accounting professional improves the details given to them by the accountant. Usually, they'll: Evaluation financial statements prepared by a bookkeeper. Assess, analyze or testify to this information. Turn the info (or documents) right into a report. Share suggestions and also make suggestions based upon what they have actually reported. The documents reported by the accountant will identify the accounting professional's recommendations to leadership, as well as ultimately, the health of business generally.e., government firms, universities, healthcare facilities, etc). An experienced and knowledgeable accountant with years of experience and first-hand understanding of accountancy applications ismost likelymore qualified to run the publications for your service than a recent accountancy major graduate. Maintain this in mind when filtering system applications; try not to judge candidates based on their education and learning alone.

Future projections and also budgeting can make or break your business. Your financial records will certainly play a massive function when it comes to this. Business forecasts and also patterns are based on your historical monetary data. They are needed to assist guarantee your business remains profitable. The economic data is most dependable and exact when supplied with a durable and also structured accountancy process.

The Only Guide for Small Business Accounting Service In Vancouver

A bookkeeper's task is to keep total records of all cash that has actually come into as well as gone out of the service. Their records make it possible for accounting professionals to do their jobs.Typically, an accounting professional or owner looks Vancouver tax accounting company after an accountant's job. A bookkeeper is not an accountant, neither ought to they be considered an accountant. Bookkeepers record economic purchases, post debits and credit scores, develop billings, take care of pay-roll and keep as well as stabilize guides. Bookkeepers aren't needed to be accredited to handle the publications for their clients or company however licensing is available.

3 main variables affect your prices: the solutions you want, the know-how you need as well as your neighborhood market. The accounting services your service needs and also the amount of time it takes regular or regular monthly to finish them impact just how much it sets you back to work with a bookkeeper. If you require someone ahead to the office as soon as a month to resolve the publications, it will certainly cost less than if you need to employ someone full time to manage your everyday operations.

Based on that calculation, decide if you require to employ somebody full time, part-time or on a project basis. If you have complicated publications or are generating a great deal of sales, employ a licensed or certified accountant. An experienced accountant can offer you assurance and self-confidence that your finances remain in good hands however they will certainly likewise cost you extra.

Fascination About Cfo Company Vancouver

If you reside in a high-wage state fresh York, you'll pay even more for a bookkeeper than you would certainly in South Dakota. According to the Bureau of Labor Statistics (BLS), the nationwide average wage for accountants in 2021 was $45,560 or $21. 90 per hour. There are numerous benefits to working with an accountant to submit and also record your business's financial documents.

After that, they may pursue extra certifications, such as the CPA. Accountants might likewise hold the placement of bookkeeper. Nevertheless, if your accountant does your accounting, you might be paying more than you should for this solution as you would normally pay more per hour for an accounting professional than an accountant.

To complete the program, accountants have to have four years of pertinent work experience. The point here is that working with a CFA means bringing very innovative audit understanding to your company.

To get this accreditation, an accounting professional should pass the required examinations and have two years of professional experience. You could employ a CIA if you want a more specialized focus on financial risk evaluation as well as protection surveillance procedures.

Report this wiki page